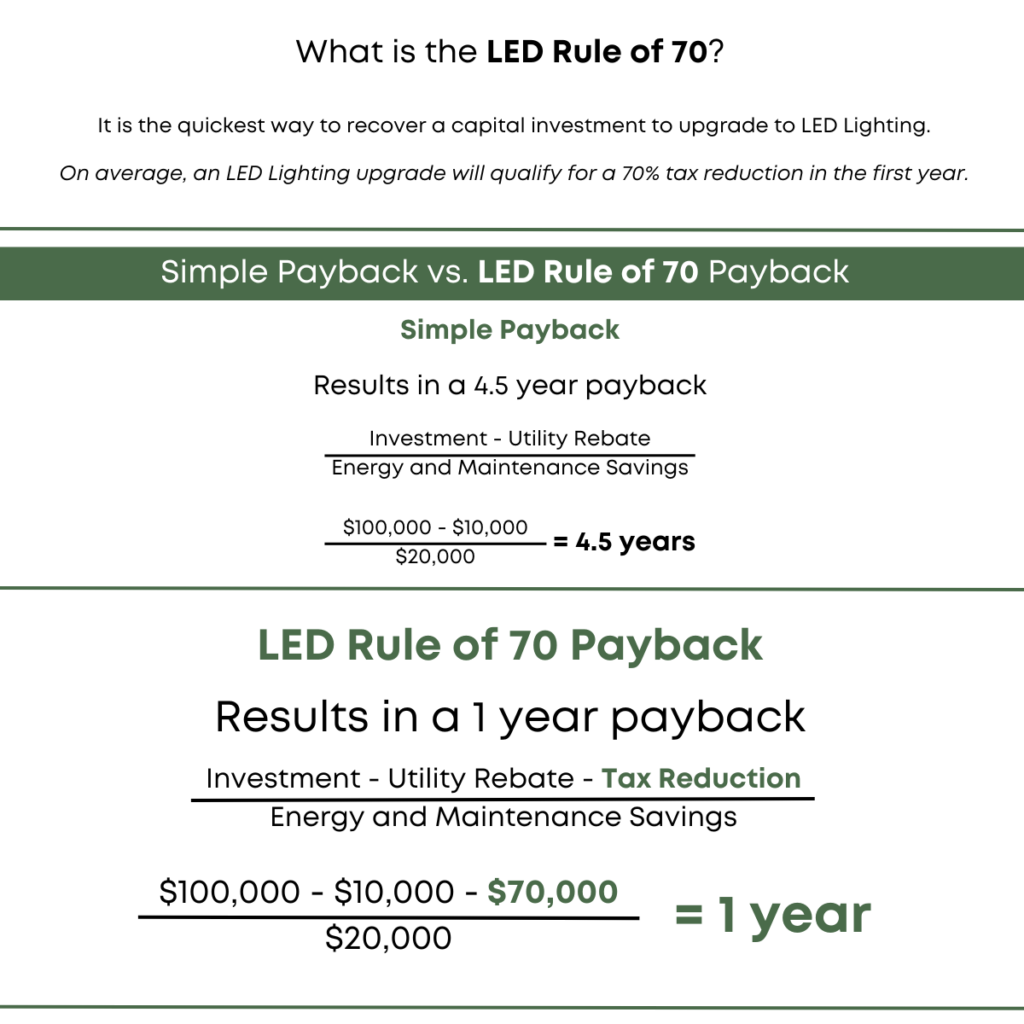

- Tax Incentives More than energy/maintenance and rebates – combined!

The government wants you to make your building more efficient, and offers tax incentives to help you pay for it.- Partial Asset Depreciation – on removal of existing (the remaining depreciation)

- Bonus Depreciation / QIP – on installation of new (applied to new equipment)

- Accelerated Depreciation – 3115 change of accounting method (we provide the required forensic engineering study)

- EPAct – Energy Policy Act – 179D

- LED Lighting Upgrade

You will eliminate avoidable profit leaks when you choose an LED Lighting Upgrade.- Reduced Energy Cost

- Reduced Maintenance Cost

- Improved Visual Performance

- Shrink Your Environmental Footprint

- Rebates

Utility companies want you to make your building more efficient, and offer rebates to help you pay for it.- Prescriptive Rebates

- Custom Rebates

- Combination Rebates

You won’t save money on LED Upgrades with TaxCentric Lighting – You’ll MAKE MONEY*

Fill out the contact form below, and we will show you how.

Custom Financing Available

Competitive interest rates.

Contact us. Find out how TaxCentric Lighting can help you.